DC OVERVIEW

The Fund's Structure

The Fund's Investment Objectives

The Fund's Investment Objectives

Membership

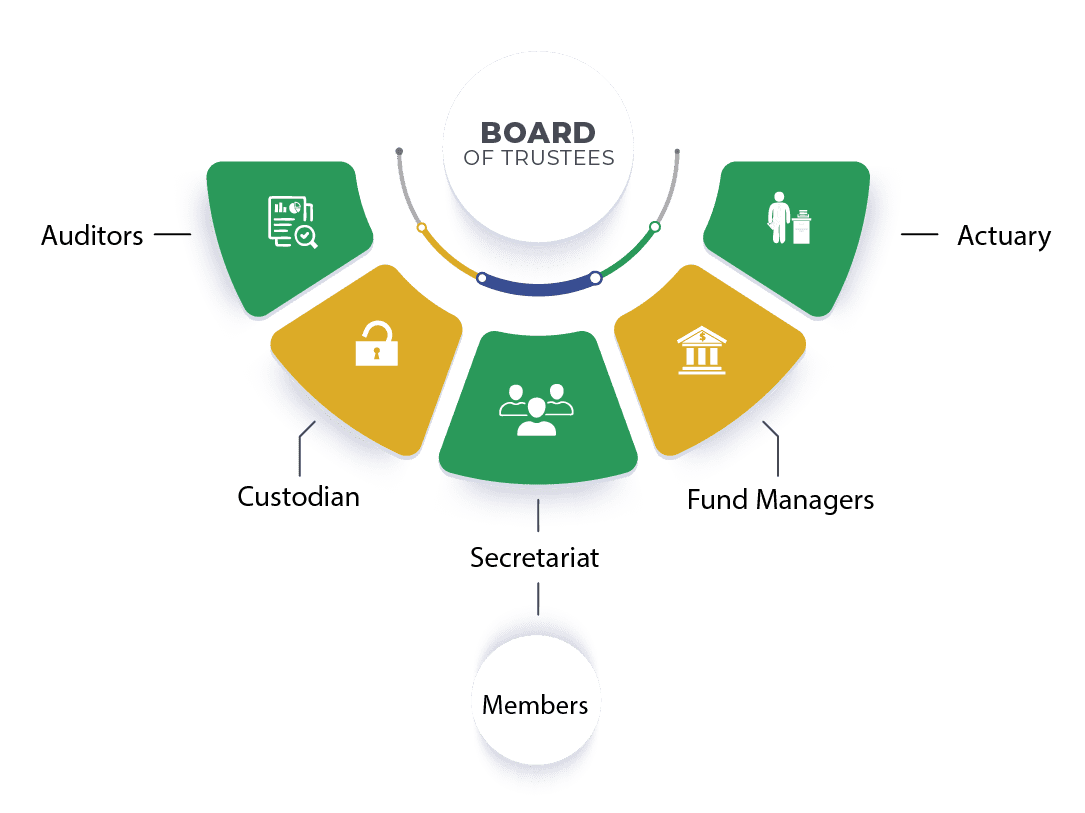

The members of the Fund comprise active in-service employees and deferred members of both Kenya Power and Lighting Company Ltd, Kenya Electricity Transmission Company Ltd, and the Nuclear Power & Energy Agency. Eligible members are permanent and pensionable employees who are above the age of 18 years. The Fund is managed by a Board of Trustees that is established under a Trust as required by the Retirement Benefits Act. The day-to-day running of the Fund is carried out by the Secretariat and supports the Board in meeting its objectives. The Secretariat headed by the Trust Secretary works in liaison with the Fund service providers, including fund managers, custodians, actuaries, lawyers, and auditors.