DB OVERVIEW

Introduction

The Kenya Power & Lighting Company Limited Staff Retirement Benefits Scheme (‘the Fund”) was established by a Trust Deed dated 1 January 1970. The Fund is a defined benefit occupational pension fund and was formed for the employees of The Kenya Power & Lighting Company Limited (‘the Sponsor’), then known as East Africa Power and Lighting Company Limited. The Fund is governed by a Trust Deed and Rules which have been approved by the Retirement Benefits Authority (RBA). The number of active members above the age of 50 years, pensioners and deferred pensioners is much greater than the number of younger active members. The Fund is approved by Kenya Revenue Authority as a retirement benefits scheme for the purposes of the Income Tax (Retirement Benefits) Rule No. 4 and is treated as an ‘exempt approved scheme’ for the purposes of that Act (1st Schedule 14).

The Fund's Structure

Fund Benefits

Retirement Benefits

Normal Retirement

These are benefits paid to members after attaining a normal retirement age of 60 years and 65 years for members living with disability. The benefits payable include a lumpsum equivalent to one third of the total accrued benefits, the remaining two thirds is paid via an option to join an Income Drawdown Fund and receive monthly/quarterly/annual benefits or purchase an annuity plan from an insurance company.

Early Retirement

The benefits payable are similar to normal retirement benefits. However, in this case a member can retire voluntarily from the age of 50 to 59 years.

Withdrawal Benefits

These are benefits payable to members upon exit from employment due to termination, dismissal or resignation. Benefits payable include members’ accrued benefits portion and 50% of the employers’ accrued benefits. The balance of the benefits is accessed any time after attaining the early retirement age of 50 years.

Immigration Benefits

These are benefits payable to a member who permanently emigrates from the country. Benefits payable are 100% of the members’ accrued benefits at the time of leaving service.

Death in Service Benefits

These are benefits payable to beneficiaries of a member upon death. The benefits payable include, Accumulated Member Benefits and Group Life-Lump Sum.

Death in Retirement Benefits

These benefits are payable to beneficiaries of a member upon death in retirement. The benefits include outstanding accrued benefits incase of an income drawdown.

ILL Health Benefits

These are benefits payable in case a member becomes incapacitated as a result of ill health. The benefits paid are similar to early retirement benefits.

The Fund's Investment Objectives

The Fund's Investment Objectives

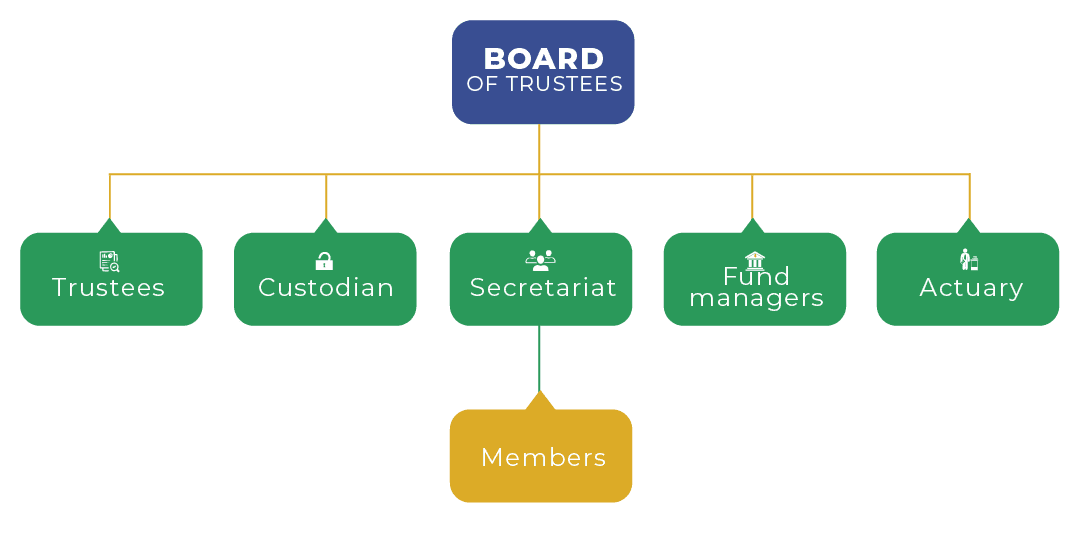

Membership

The members of the Fund comprise of active in service employees who were employees of the Sponsor as at June 2006, deferred members of the Fund and retirees. The Fund is managed by a Board of Trustees that is established under a Trust as required by the Retirement Benefits Act. The day to day running of the Fund is carried out by the Secretariat that supports the Board in meeting its objectives. The Secretariat headed by the Trust Secretary works in liaison with the Fund service providers that include fund managers custodians, actuaries, lawyers and auditors.